Improving your trading processes requires a thorough theoretical background. Market practices for finance and logistics are changing, which will make significant adjustments to your daily business operations. How do you keep up with new trends in transactions with the issuing and advising banks?

First of all, let's start by recalling the basic definitions of these two terms.

Brief definitions of the terms

What is an advising bank in LC?

This is an institution that is called upon to confirm the legitimacy and notify the bank's client (beneficiary/exporter, i.e. supplier) of the terms of the letter of credit (LC), which are the client's payment obligations.

What is an issuing bank?

This is an institution that is required to set the terms and conditions and specify the obligations in letters of credit (LCs). In addition, the importer (consignee) can send a request for the creation/issuing of an LC. After that, the issuing bank pays the amount specified in the letter of credit at the national bank's exchange rate, subject to fulfillment of the conditions specified in it.

For more details on the roles and practical examples of the advising bank and issuing bank operations, please refer to our previous article "International Maritime Trade: Basic Concepts".

Characteristics of Issuing Bank and Advising Bank

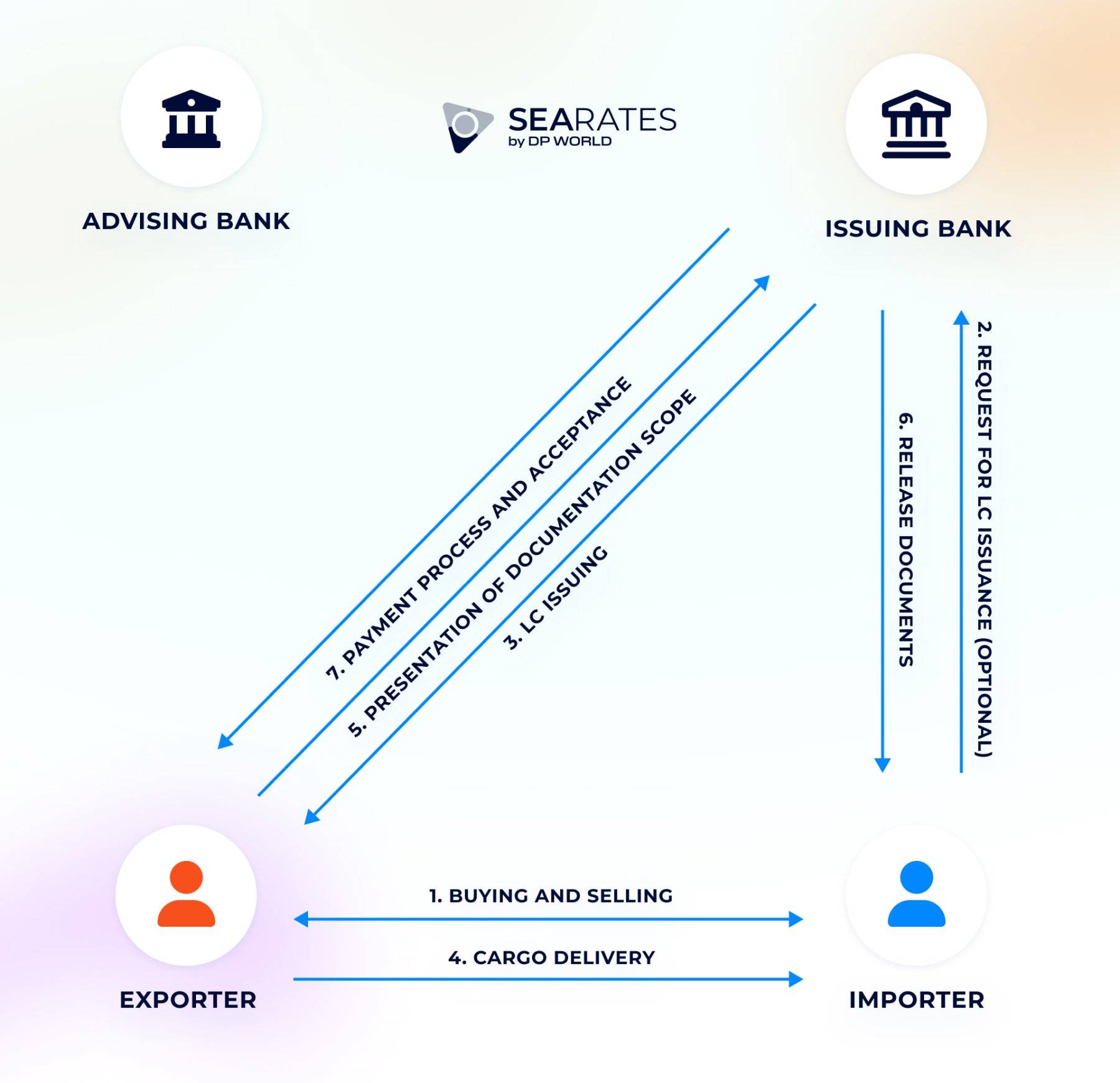

Explore our simplified schematic to compare the obligations and functions of the issuing bank and the advising bank:

| Scope of activities and responsibilities | Issuing bank | Advising bank |

| Operations with letters of credit (LCs) | Prepares and issues the letter of credit. | Transfers the LC to beneficiaries directly. |

| Roles selection/sequencing | Selects and defines the role of each bank upon LC terms. | Has a choice between serving as an advising bank to transmit the LC to the beneficiary or reporting the issuing bank without any communication with a client. |

| Document checking process | Checks documents for compliance with the transaction’s requirements. | Has no direct obligation to verify. This could be done for an additional fee without any support or guarantees on their part. |

| Payment handling | Has a direct obligation to pay specific amounts to beneficiaries. Has to reimburse the confirming banks for honoring a compliant presentation. | Has no liability for payment. Any changes to the letter of credit are made on the basis of no obligation. |

Impact of digitalization: ATB (Advice Through Bank) Practice – “Directly-advised” Letter of Credit

Let's take a look at the scheme and analyze how direct advice to the beneficiary works in practice.

Why did it become necessary to omit such an institution as an advising bank from the financing of logistics and trade operations? After all, throughout history, it has been necessary to ensure the transparency of manual letter of credit transaction processing and verification. The answer is the digital revolution and the digitalization of logistics in general. From now on, in most cases, there is no need to manually verify a letter of credit, as transactions are processed efficiently, and it is enough to send an e- or paper version of the document.

Advantages of ATB Practice – “Directly-advised” LCs

For example: As a cargo shipper from Dubai, UAE, Cairo, EG, or other cities in the Middle East or Asia-Pacific region, such as Houston, US, Busan, KO, Shanghai, CN, and so on, you need a letter of credit with an agreed cargo price provided by the advising bank and financing with a better exchange rate provided by the issuing bank. However, you may encounter the following practice, which is common in these two regions: issuing banks may offer you letters of credit with self-advising. What is the reasoning behind this?

How does a "Directly-advised" Letter of Credit increase the security of your transactions?

The simplest explanation is that there are fewer parties involved, which means less possibility of misunderstandings between the institutions and the beneficiary. As already mentioned, the advising bank is responsible for processing and delivering the letter of credit to the cargo exporter but does not have all the details about the document that the issuing bank has.

How does ATB reduce costs and optimize your transportation budget?

Single consultations for new clients of the advising bank cost in the range of $60-120, which for regular clients is $30-80 for each consultation as well. You can eliminate an unnecessary expense item from your transportation budget by avoiding consultations and changes to the letter of credit through an advising bank.

How does this improve the efficiency and speed of financing?

You reduce the time required to verify the validity of the LCs and communicate additional terms and conditions to you, as this can all be done at the issuing bank.

Risks of ATB Practice – “Directly-advised” LCs

Improper provision of services by the issuing bank

This problem is addressed by third-party supervisory institutions and audits confirming that the issuing bank assumes and fulfills all obligations to the beneficiary. The most important thing is to communicate quickly about any changes in letters of credit, etc.

Fake beneficiary identity data

However, it is not only the issuing bank that can act as a party if it does not comply with its own obligations. To avoid dishonesty and fraud by the beneficiary, it is enough to go through the KYC [know your customer] process, verify all the documentation registered for the client company’s finance report, and so on.

So, these are all the risks you may face at different stages of an LCs (letters of credit) transaction.

End Note

The financing of your trading operations is already subject to significant changes. To understand the processes of the industry accurately, we have explained the concepts of an advising bank and an issuing bank, as well as their essential details.

With our support for your shipping logistics operations, all you need to do is reach out to the SeaRates team for consultation on any of your issues. We will be happy to provide you with all the assistance you require to achieve the benefits of your business development.

Contact us at [email protected] for any questions you may have about your supply chain.