Each of the parties in the global supply chain has faced a significant shipping security obstacle in one of the world's key transportation arteries. The incident in the Suez Canal led to its blockage, which disrupted the booming trade across the Red Sea. Let's take a closer look at the causes and global impact of the incident on international trade, as well as practical solutions to improve global logistics today.

Defining the role of the Suez Canal in the global logistics industry

Before we get into the challenging new trends that you, as a freight forwarder or shipper, should prepare for, let's highlight the nuances of the Suez Canal's strategic importance to global logistics and trade.

The critical importance of the Suez Canal in world trade is determined by the need to connect trade routes between the Far East and Northern Europe, the Asia/Indian subcontinent, and Europe/America, as well as between the Middle East and Europe. Trade networks between the Mediterranean and the Red Seas required the ability to transport goods, which led to the opening of the artificial shipping channel in Egypt, the Suez Canal, in 1869.

Efficiency gains due to shorter shipping distances have always been significant, which is where the importance of the Suez Canal comes in. The canal's total length is 190,25 km, through which about 30% of the world's sea freight traffic was recorded. It was expected that the past year 2023 would be a positive milestone for Egypt's financing due to the oil supply and popularity of use - up to 60 types of vessels per day are transported through the canal, i.e., up to 19,000 per year on average. This was the case until the recent events at the end of last year.

Latest updates on the Red Sea and Suez Canal situation

In the Red Sea, the Strait of Bab el-Mandeb (also known as the Gate of Tears), which borders Yemen, Djibouti, and Eritrea, strategically connects the Gulf of Aden and the Indian Ocean. This waterway preceded the blocking of the Suez Canal, as it has been actively attacked by terrorist groups, including the Houthis, since November 2023. Previously, only Israeli-affiliated vessels were attacked, and then any shipping in the region was directly threatened, impacting Red Sea trade.

On December 15, 2023, Hapag-Lloyd suffered an attack on our vessel 'Al Jasrah'. Vessels of shipping companies from more than 35 countries were targeted.

The first response was to abandon the use of shipping routes through the Suez Canal and the Red Sea and look for alternatives from the following logistics leaders: Danish A.P. Moller-Maersk, Italian-Swiss giant Mediterranean Shipping Company, French CMA CGM, German Hapag-Lloyd, Belgian Euronav, as well as oil giant BP, Taiwanese shipping company Evergreen, and one of the world's largest tanker companies, Frontline.

The global impact of the Suez Canal lockout on international trade and logistics

The previously mentioned freight routes between the Far East and Northern Europe, Asia/Indian Subcontinent, and Europe/America, as well as between the Middle East and Europe, have been subject to fundamental economic and security changes. The decision of shipping companies to bypass the sea route is a fundamental game-changer for the world's shipping and trade landscape, as Maersk alone is responsible for 15% of the world's container traffic. In addition, the company's representatives emphasize the need to strengthen the security component of logistics in the area. On December 24, Maersk announced that it would likely resume shipping through the Red Sea only if Operation Prosperity Guardian is created to strengthen maritime security in the region. So, we can clearly observe how the ongoing Suez Canal crisis serves as a foundation for potential improvements in logistics security.

How did the economic impact of the disruption take shape?

Undoubtedly, insurance and fuel costs have skyrocketed because of the Red Sea situation. The suspension of sailings through the Red Sea caused spot rates for sea freight to rise by 20% immediately after December 15, 2023, as evidenced by the latest data on the logistics market.

Shipping through the Cape of Good Hope takes much longer than through the Suez Canal, namely 10-14 days longer, which also incurs additional costs. It is estimated that an additional USD 1 million will be spent on fuel for each shipment between the Far East and Northern Europe. Longer transit times also negatively impact the extra use of about 20% of the global supply chain capacity.

SeaRates solution: Take a look at case studies

In addition to the Suez Canal trade route, the Bab el-Mandeb Strait, which until recently carried 15% of the world's trade, was blocked. The Red Sea trade is avoided for shipping by 20% of the world's container vessels. Instead, shipping is finding alternative methods of routing in Africa, specifically South Africa's Cape of Good Hope. How easy is this alternative?

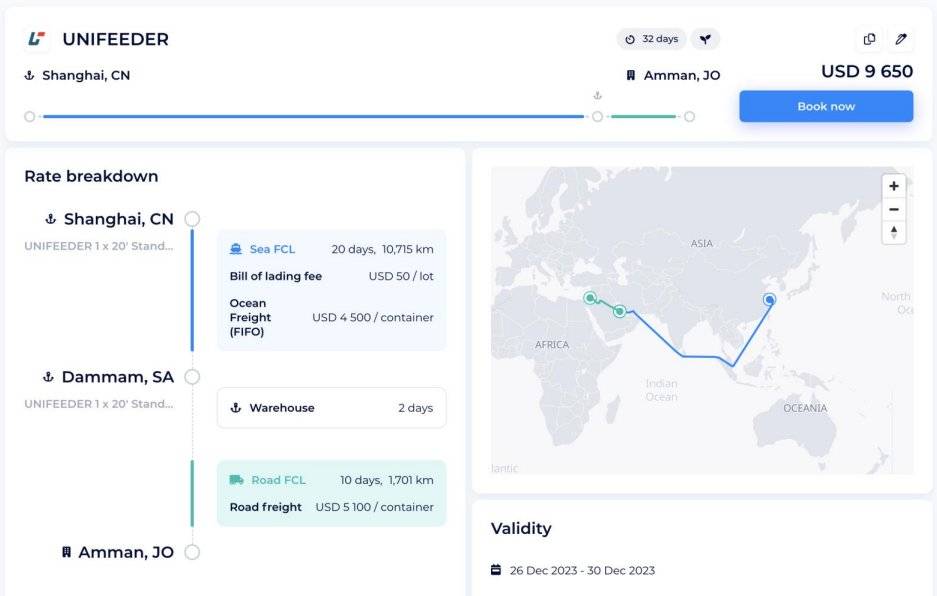

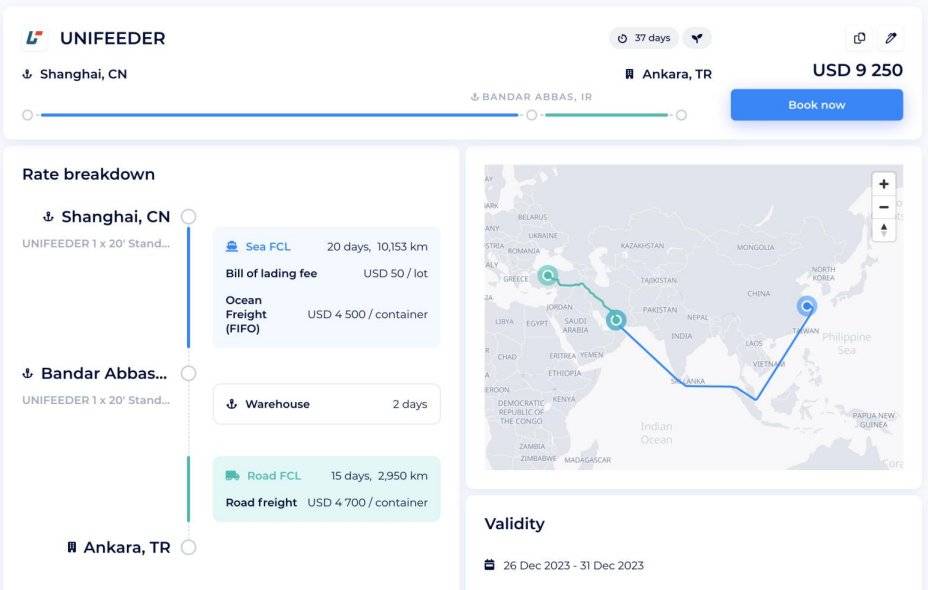

SeaRates presents the Jordan and Turkey case studies for alternative use, where the routes pass through Dammam, SA, and Bandar Abbas, IR, respectively. You can find new schedules for alternative Suez Canal shipping routes on the Ship Schedules tool or integrate them into your website for use by your customers:

Final Thoughts

Our team adheres to clause 18 of our Terms and Conditions of the Bill of Lading / Sea Waybill ("Matters Affecting Performance"), which encourages us to promptly provide effective solutions to ensure the safety of the vessels' crew and cargo. Consequently, we immediately responded to the incident and blocked any transportation, bypassing the Suez Canal and the Red Sea, directing vessels to bypass the Cape of Good Hope, etc. The period since the end of the previous year has already shown the effectiveness of the results of the alternative routes, of course, as well as the improved safety.

The SeaRates team understands the long-term impact the incident has on the freight forwarding community, including the contracting of the next few years. We are monitoring and continuously assisting you in the logistics and negotiation process between shippers and carriers in the difficult situation that has occurred.

The expected stabilization of the market and the security component is a positive outlook, which we will announce by resuming the previous shipping schedule. Ship safely with SeaRates!

Contact us at [email protected] for customized assistance in your logistics and trading processes.